The Board has three standing committees: an audit committee, a compensation committee, and a health, safety, sustainability and environmental committee (“HSSE committee”), each of which is chaired by an independent director. The HSSE committee assists the Board in fulfilling its oversight responsibilities with respect to the Board’s and EVA’s continuing commitment to (1) ensuring the safety of our employees and the public and assuring that our businesses and facilities are operated and maintained in a safe and environmentally sound manner, (2) sustainability, including sustainable forestry practices, (3) delivering environmental benefits to our customers, the forests from which we source our wood fiber, and the communities in which we operate, and (4) minimizing the impact of our operations on the environment. The HSSE committee reviews and oversees our health, safety, sustainability, and environmental policies, programs, issues, and initiatives, reviews associated risks that affect or could affect EVA, its employees, and the public, and ensures proper management of those risks and reports to the Board on health, safety, sustainability, and environmental matters affecting EVA, its employees, and the public.

Upon Enviva’s conversion to a corporation, from a master limited partnership, on December 31, 2021, we added a fourth standing committee: The Nominating and Corporate Governance Committee.

- Enviva Rationale for Issuance

The Green Finance Framework connects Enviva’s renewable energy focused development plans with its funding and financial strategy. Instruments aligned with Enviva’s Green Finance Framework help fight climate change while funding job-creating initiatives that have meaningful economic impacts on local communities.

- Enviva Green Finance Framework

Enviva’s Green Finance Framework will guide future issuances of Green Finance Instruments including green bonds, convertible bonds, and term loans by Enviva and its subsidiaries. Our Framework was developed in alignment with the Green Bond Principles (2021) as published by the International Capital Markets Association (“ICMA”) and the Green Loan Principles (2021) published by the Loan Market Association (LMA) and the Loan Syndications and Trading Association (LSTA). Should Enviva issue a green convertible bond, the Green Finance Framework is only valid for the instrument until the time of conversion from the bond to common stock. It uses the core components of the principles and key recommendations:

- Use of Proceeds

- Process for Project Evaluation and Selection

- Management of Proceeds

- Reporting

- External Review

4.1 Use of Proceeds

An amount equivalent to the net proceeds raised from the sale of any Green Finance Instrument aligned with this Framework will be utilized to finance and/or refinance, in whole or in part, one or more Eligible Projects across the Eligibility Criteria that follows. Enviva intends to allocate the net proceeds from any Green Finance Instrument toward Eligible Projects made between the 36 months prior to or 24 months after any such issuance. Enviva intends to disclose amounts refinanced vs. financed as part of its ongoing Reporting commitments. Eligible Projects may include research, development, acquisitions, and capital expenditures in initiatives aligned with the Eligibility Criteria.

Eligibility Criteria is defined by any of the following:

| Green Eligible Projects: Environmental Objective |

Criteria |

UN SDG Alignment |

| Renewable energy: Climate change mitigation |

Investments and/or expenditures that are designed to increase biofuel renewable energy production and distribution capacity, including:

· The development, construction, and/or purchase of biofuel production plants, port terminals, and related infrastructure. |

7, 13

|

Enviva’s operations are focused on sustainable biofuel production, and so our products displace fossil fuels in energy generation processes. As such, Green Eligible Projects exclude fossil fuel related expenditures.

4.2 Process for Project Evaluation and Selection

An ESG Committee that includes members of Enviva’s Executive, Business Development, Sustainability, and Finance teams will work closely with other strategic decision makers to assess and select Eligible Projects that are aligned with Enviva’s Green Finance Framework and its broader commitment to expanding biofuel renewable energy generation. Business Development will bring a prospective project to the attention of the ESG Committee, and the Sustainability and Finance teams will gather additional information to assess if projects align with the Eligibility Criteria outlined in the Use of Proceeds section, and finally the ESG Committee will evaluate the project’s alignment with the Eligibility Criteria and approve projects for inclusion.

Enviva has policies in place to monitor and manage environmental and social risks in its operations – all major investment decisions reflect these policies, and the ESG Committee will confirm alignment when identifying and approving Green Eligible Projects.

4.3 Management of Proceeds

The ESG Committee will track net proceeds from any Green Financing that are allocated toward Eligible Projects. The Finance team will be responsible for keeping an up-to-date account of issued net proceeds, eligible allocations, and unallocated proceeds, providing updates to the broader ESG Committee. Pending allocation, proceeds will be managed in-line with Enviva’s existing liquidity practices, which may include general corporate purposes, investment in cash or other liquid securities, or repayment of outstanding indebtedness. Payment of principal and interest on Enviva’s Green Financings will be made from the Company’s general account and not tied to the performance of any specific Eligible Project. In the unlikely case of divestment or if a project no longer meets the eligibility criteria listed above, Enviva will use reasonable efforts to reallocate the funds to other Eligible Projects during the term of the relevant instrument.

4.4 Reporting

Annually until full allocation of the net proceeds from any Green Finance Instrument, Enviva expects to publish information on our website that includes information on allocations and, where feasible, associated impacts.

The Green Finance Report is expected to include information on (i) amounts allocated to Eligible Green Projects broken out by refinanced and new projects (including specific developments where confidentiality permits), (ii) the amount of net proceeds pending allocation, and, where feasible, (iii) case studies with additional information on highlighted projects, and (iv) impact reporting as described below. The report will be accompanied by management attestation regarding the amount of net proceeds from any Green Financing that have been allocated toward Eligible Projects.

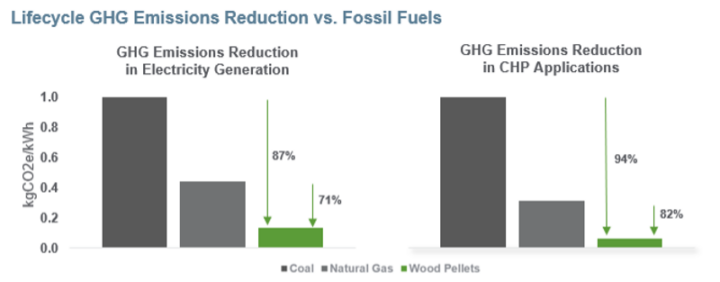

Impact reporting will focus on quantitative and / or qualitative assessments of the sustainability impacts of Enviva’s Green Eligible Projects, such as the amount of increased biofuel renewable energy production capacity, the amount of greenhouse gas emissions avoided as a result of Enviva facilities, and the amount of displaced coal (and / or other fossil fuels). Impact reporting will largely be based on expected impacts until new facilities become operational. Once operational, actual impacts will be reported. Enviva publicly shares information about the methodologies used to calculate environmental impacts, and Green Finance Reports will include relevant links to studies and calculations.

In addition to the identified positive environmental impacts, Enviva’s Green Eligible Projects create social benefits as well, and where feasible, Enviva may also include social impact reporting, such as the number of jobs created in rural communities.

4.5 External Review

Second Party Opinion

Enviva commissioned S&P Global to conduct an external review of its Green Finance Framework and to issue a Second Party Opinion (SPO) on the Framework’s alignment with the International Capital Market’s Association’s Green Bond Principles (2021). The SPO is now publicly available.

Verification

Upon full allocation of an amount equal to the net proceeds of each Green Financing, Enviva will obtain an assurance report reviewing and confirming the allocation of the offering to eligible expenditures from a qualified independent external reviewer.

- Disclaimers

Industry and Market Data

This document has been prepared by Enviva and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Enviva believes these third-party sources are reliable as of their respective dates, Enviva has not independently verified the accuracy or completeness of this information. Some data is also based on Enviva’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above.

Cautionary Note Concerning Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding Enviva’s future financial performance, as well as Enviva’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Enviva disclaims any duty to revise or update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Enviva cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Enviva.